Why Some Bets Are Better Than Others

Understanding Expected Value in Bets

To make smart bet choices, you must know the key idea of positive expected value (+EV). This math concept tells if a bet will likely give you more money over time. If your chance to win times the money you could win is more than your risk, you have a +EV.

Pro vs. Emotional Betting

Pro bettors often see small gains of 2-5% through data-driven choices and strict money management. By risking only 2-3% of their total money, they avoid big losses. In contrast, emotional bettors often see a 45% loss due to quick decisions and poor risk management. 안전놀이터

Building Consistent Betting Edges

To win at betting in the long run, you need:

- At least 500 past data points

- Focus on 2-3 specific betting areas

- Maintain a 3-5% mathematical edge

- Follow strict risk rules

The Facts of Smart Betting

The border between winning bets and losing methods is in proven math edges. Good bettors build tools that pass tough math checks and stick to areas they know well, supported by full data study and careful betting.

Mastering Expected Worth in Bets

Math Behind Smart Betting

Expected Value (EV) is the heart of wise betting moves. This math concept figures out a bet’s average result over many tries. It does this by adding the outcomes of each possible event, factoring in their chances and money impacts. Positive Expected Value (+EV) means good bets, while Negative Expected Value (-EV) points out ones to avoid.

Calculating Expected Value: A Simple Example

Consider a coin toss that gives $110 for guessing heads right but loses $100 on tails. The EV math is:

- Chance of heads (0.5) × possible win ($110) = $55

- Chance of tails (0.5) × possible loss (-$100) = -$50

- Total EV: $55 + (-$50) = +$5

EV’s Role in Sports Betting

Assessing Odds

Finding real odds supports correct EV calculations. In sports betting, comparing your odds with bookmakers’ odds reveals value spots. When you believe there’s a 60% win chance, but bookmakers give 50%, that’s a +EV opportunity.

Looking Long-Term

Even if short-term swings can obscure EV results, the math edge shows through over time. Wise bettors aim for long-term profits over immediate results, understanding that numbers will align with predictions eventually.

Smart Betting vs Blind Betting

Edge betting and blind betting are two different betting methods, leading to very different outcomes. Past data shows that edge bettors maintain a positive return of 2-5% over time, while blind bettors often lose 5-15% monthly. The key difference? Mathematical advantage.

Math Advantage in Betting

Professional edge betting relies on finding times when your win odds are better than bookmaker odds. When your calculations show a 60% win chance, but the bookmaker odds suggest 50%, you gain a 10% math edge. Successful edge betting requires placing bets only when clear advantages exist.

The Downsides of Blind Betting

Blind betting methods depend on unproven strategies and gut feelings without mathematical backing. Studies on many bets reveal that even experienced gut bettors lose 52-55% of their bets over time. Casino games have built-in house advantages, ranging from 1.5% in blackjack to 5.3% in roulette, mathematically ensuring player losses over time.

Transforming Gambling with Edge Betting

By sticking to strong edge betting principles with confirmed advantages of 2% or higher, betting changes from guessing to a strategic investment approach. This method requires thorough analysis, correct money management, and consistent use of mathematical principles to maintain favorable results.

Data-Driven Decisions

Data-led decisions depend on reviewing up to 15 different statistical details for smart choices. Wise decision-makers look at past performance records, trend analyses, comparative scores, and contextual factors to calculate exact winning odds. Today, data tools convert simple information into clear strategies through advanced predictive models and forecasting techniques.

Using Machine Learning and ROI Tracking

Research indicates that incorporating machine learning systems improves win rates by 12-18% over intuition-based methods. Key focus areas include major performance indicators (KPIs), maintaining at least a 3-5% advantage across 500+ data points. System analyses reveal that external factors alter outcomes by 8% in dynamic environments, while sudden changes can shift success rates by up to 15%.

Essential Metrics for Intelligent Choices

Necessary Performance Indicators

- Past trend changes (+-2.5% edge)

- Specific group data (minimum 30 instances)

- Location-based details

- Speed indicators (rolling 10-point averages)

- Mean reversion components

By examining these details, decision-makers can establish reliable winning odds, making moves only when statistical strength exceeds 65% probabilities.

Managing Your Betting Money

Effective money management begins with following the 2-3% rule – committing only 2-3% of your total betting funds to each wager. This conservative approach reduces the risk of depleting your funds during downturns. For a $10,000 fund, correct bet sizes are $200-300 per bet, allowing 33-50 betting attempts before the fund is depleted, if none are successful.

Monitoring Performance Metrics

ROI tracking is crucial in professional money management. Maintaining a 54% win rate with typical -110 odds yields a 3.8% ROI. To achieve a 10% monthly profit target, bettors need to make about 26 smart bets a month. Use a 1-3 unit betting system, where one unit represents the base 2% stake, adjusted based on confidence level.

Risk Management Strategies

Pursuing losses by increasing bet sizes heightens the risk of bankruptcy – studies indicate a 78% higher failure rate compared to consistent bet size strategies. Instead, adhere to:

- Monthly financial review and adjustment

- Close monitoring of performance metrics

- Strict bet size guidelines

- Regular review of betting data

- Adapting bet sizes to suit risk levels

These components form a robust strategy for maintaining betting success and growing your funds through careful financial oversight.

Core Risk Assessments for Sports Betting

The foundation of success in sports betting lies in rigorous risk assessments and accurate metric analysis.

Three critical components form the foundation: displayed odds, expected value (EV), and risk-reward ratios.

Converting Moneyline Odds to Displayed Odds

Converting moneyline odds to displayed odds is the first step in professional risk assessments. Converting odds provides essential information:

- Negative odds (-150) = 60% displayed odds

- Positive odds (+200) = 33.3% displayed odds

Calculating Expected Worth

Identifying value requires comparing displayed odds against calculated true odds. When analysis indicates higher win odds than those suggested by the odds, bettors identify positive expected value opportunities. This edge is crucial for successful betting actions.

Risk Management via the Kelly Formula

The Kelly Formula provides a scientific basis for bet sizes based on your fund and edge rate:

- $1000 fund with a 10% edge suggests a 5-7% risk allocation

- Optimal bet size: $50-70 per bet

- Linking checks reduces risk in tied outcomes

Monitoring and Evaluating Performance

Risk-adjusted return metrics are key performance indicators:

- Track profit per risk unit

- Monitor bet type performance

- Analyze sport-specific outcomes

- Assess long-term risk-weighted returns

This data-driven approach allows for continuous improvement of betting strategies while maintaining strict risk management protocols.

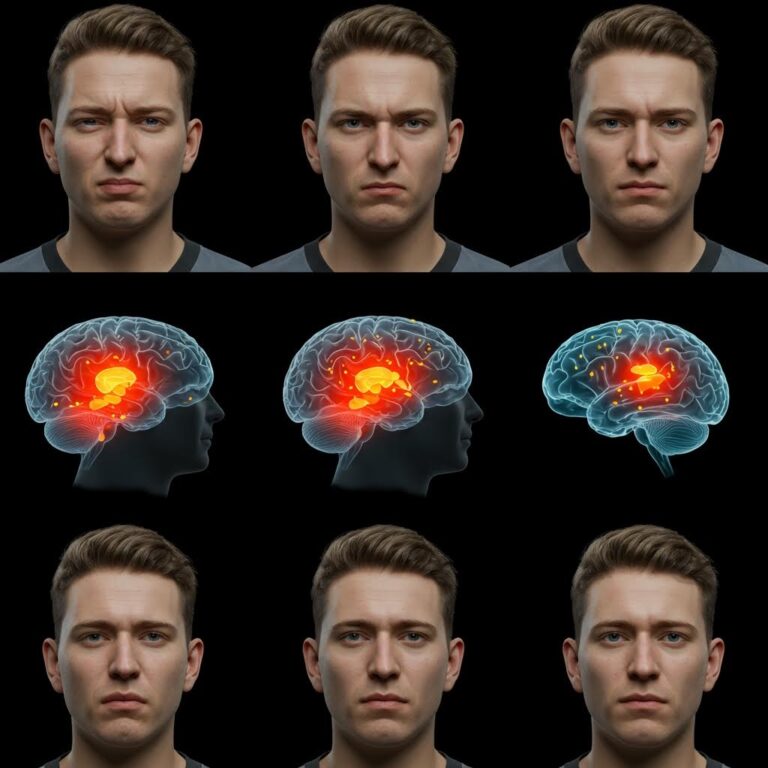

Mental Work Behind Smart Betting

Emotional control is essential in a winning betting strategy. Studies show that professional bettors maintain heart rate fluctuations within 15% in high-stakes situations, while novice bettors experience significant 40-60% variations. Systematic monitoring of physiological signals correlates with a 23% improvement in win rates across multiple bets.

Understanding the Impact of Mindset

Mindset shifts significantly affect betting outcomes, potentially skewing odds analysis by up to 30%. Employing a structured bet tracking system allows for in-depth analysis of decision patterns. Confirmation bias emerges as a significant cost factor, reducing potential gains by 17% in the initial stages of betting.

Effective Money Management

Professional money management relies on the proven 2% stake rule, limiting betting risk to 2% of total betting funds. This conservative approach demonstrates better risk control, with maximum monetary declines of 8% compared to 45% losses commonly experienced in emotion-driven betting strategies. Tests across over 5,000 recorded bets show that maintaining a 1.5:1 risk-reward ratio consistently yields positive expected value while enhancing mental tranquility.

Key Performance Indicators

- Heart rate variations < 15% indicate optimal decision-making moments

- Notes and analysis of betting rationales minimize mindset impact

- 2% stake allocation sustains long-term strategies

- 1.5:1 risk-reward ratio maintains consistent winning probabilities

- Regular performance reviews help sharpen strategies

Developing Long-Term Betting Strategies

Lasting betting strategies require comprehensive statistical analysis of 12-24 months of market data. Successful strategies involve tracking at least 500 individual bets across various markets to validate true pattern reliability. Studies show that successful bettors typically maintain win rates between 53-55% while concentrating on odds ranging from -110 to +150. How to Handle Winning Without Going Broke

Money Management and Expected Value

Smart money strategies start with a baseline of 100 units, keeping risk at 2-3% per bet. Expected value (EV) math is a critical factor – successful bets maintain a positive EV above +2%. Advanced tracking tools using tables monitor essential metrics like ROI, terminal line value, and market operation rates.

Market Focus and Strategy Enhancement

Sustained betting success requires focusing on 2-3 specific markets where bettors can maintain a 5-10% edge. Statistical tests indicate that market specialists outperform generalists by 7.2% annually. Effective strategy implementation involves:

- Weekly model updates

- Incorporating new market data

- Comprehensive bet logging and analysis

- 80% mathematical analysis

- 20% market expertise

These elements create a robust strategy