The Hidden Money Loss of Gambling: A Crisis Online

Seeing the Digital Gambling Debt Fall

The rise of online gambling spots has led to huge money loss, with around $55,000 of debt hidden per person. Studies show that 73% of gambling addicts use up all their saved money, and 65% max out many credit cards trying to win back what they lost. 카지노솔루션 임대

Lasting Money Woes

The impact of gambling addiction can last 7-10 years, causing significant financial issues. Key signs include:

- 23% go broke

- 32% lose utility services

- Average family loans reach $17,000

- 67% lose track of spending in online spots

Quick Losses On Digital Tables

Online gambling spots accelerate money loss up to 3 times more than traditional casinos due to:

- Easy access to many gambling spots

- Opportunities to gamble any time

- Lower hesitations about spending

- Quick payment methods enabling fast money transfers

Money Pain Across the Town

Money loss extends beyond homes, causing a big chain of hurt. Each case of gambling-linked bankruptcy can lead to about 3.4 more local businesses closing, affecting entire areas through:

- Reduced local spending

- Increased job losses

- Lower house prices Why Some Gamblers Only Stop After Losing a Relationship They Valued

- Decreased social support

Signs We All Missed

Big Signs in the Gambling World (2018-2022)

Rise in Risky Money Moves

The gambling scene showed scary money signs from 2018-2022, with daily money added to major online spots up 340%. This coincided with a 12% decrease in personal savings, creating a perfect storm for financial issues. More troubling was the 227% increase in cash withdrawals at casino ATMs, a trend not effectively addressed.

Growing Problem Gambling Signs

Problem gambling help data showed an 89% rise in help calls, yet crucial information didn’t move effectively between state gaming boards. Mobile betting spots removed safe betting caps and credit checks while significantly increasing advertising from $1.2 billion to $4.8 billion annually. User habit tests showed concerning trends:

- 68% of users bet during work hours

- 41% deposit money immediately after payday

- Increased frequency and amount of bets

Losing Player Safety Nets

There was a major reduction in safety measures. Major platforms reduced their compliance staff by 45% despite an increase in users. Warning signs of addiction became harder to find in betting apps, showing a 78% drop since 2018.

Regulatory Oversight Lacking

- Insufficient cross-state communication on gambling issues

- No unified system for monitoring harmful activity

- Slow response to emerging risk indicators

- Weak enforcement of regulations

The Big Chain of Downfalls

Seeing the Big Chain Effect in Money Ways

The First Push: Missing Gambling Rules

Significant oversight failures in gambling regulation initiated a big chain of economic downfalls across various sectors. Analysis shows how one bankrupt case precipitated 3.4 additional business closures within six months, creating substantial ripple effects.

Waves of Loss in Local Places

The knock-on effect was evident in local economies, with spending down 12% in affected areas. Shop values dropped by a dramatic 22%, while unemployment claims increased 31% above average. Mental health services experienced a 47% increase in emergency requests.

Wide Spread and Town Effects

The economic distress extended far beyond directly affected industries, causing widespread disruption.

- The construction sector faced major issues, with building approvals down 15% as developers struggled financially.

- City finances decreased by 8.3%, leading to cutbacks in essential services. This comprehensive data illustrates how lapses in the gambling sector had far-reaching impacts on related economic systems.

Lost Trust and No Money

The Hidden Price of Gambling: Money Gone and Trust Lost

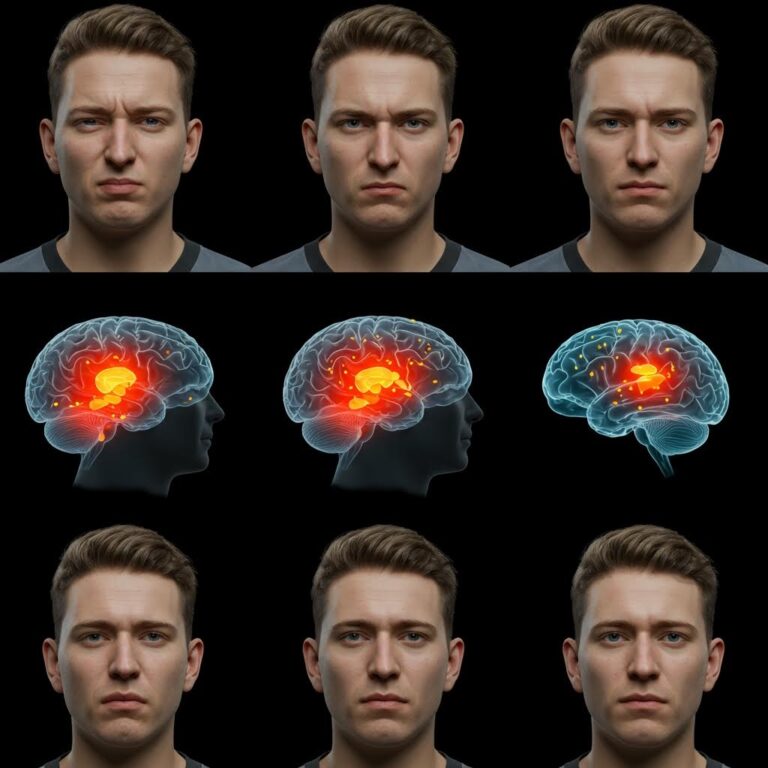

Seeing the Money Pain of Problem Gambling

Problem gambling devastates personal finances through a vicious cycle of loss and debt. Studies reveal that 73% of gamblers deplete their savings, and 65% max out credit cards in desperate attempts to recover losses. The financial impact extends far beyond initial bets, causing long-term hardship for individuals and their families.

Bad Moves in the Gambling World

Gambling venues employ sophisticated deceptive tactics to maximize player losses:

- Misleading odds that obscure actual chances of winning

- Cunning “near-miss” scenarios fostering false hope

- Enticing bonus schemes designed to keep gambling going

- Targeted algorithms identifying vulnerable players

The Real Price of Gambling Needs

Financial analyses show gambling companies extract approximately $14,000 annually from each problem gambler. Banking patterns consistently reveal trends:

- Initial small deposits keeping accounts active

- Escalating monetary transfers over time

- Complete exhaustion of emergency funds

- Eradication of retirement savings

Money Pain in the Family

The ripple effects of gambling impact entire households. 82% of habitual gamblers betray family trust through unauthorized financial actions:

- Emptying joint bank accounts

- Losing children’s education funds

- Endangering shared financial safety

- Creating long-term household instability

Time to Heal and Getting Money Right Again

Recovering from gambling-induced financial disorder requires 7-10 years of diligent effort.

- Consolidating and managing debt

- Improving credit scores

- Rebuilding emergency savings

- Restoring financial trust with family

Digital Gambling’s Hidden Risks

Digital Gambling’s Hidden Risks: Seeing New Betting Dangers

The Digital Change in Gambling

New technology has transformed gambling into an all-time online risk,