Featherlight Fortunes: Strategic Betting for Sustainable Wins

The Power of Micro-Betting Strategy

Strategic wealth building through betting requires a calculated “featherlight” methodology that prioritizes precision over volume. This data-driven approach focuses on controlled risk management and systematic position sizing to generate consistent returns.

Core Principles of Sustainable Betting

- Position Sizing: Maintain strict 1-3% capital allocation per wager

- Pattern Validation: Analyze 20-30 betting cycles before commitment

- Risk Management: Reduce portfolio volatility by up to 40%

- Win Rate Threshold: Scale positions only after achieving 54% success

- Timing Optimization: Capitalize on early-week odds advantages of 8-10%

Advanced Performance Metrics

Systematic tracking and detailed analytics form the foundation of successful betting strategies. Meticulous documentation of each wager enables pattern recognition and strategic refinement, leading to enhanced decision-making capabilities.

FAQ Section

What is the optimal position size for beginners?

Start with 1% of total capital to minimize risk while learning market dynamics.

How long should I track results before scaling positions?

Monitor performance across minimum 20-30 betting cycles to establish reliable patterns.

What metrics indicate readiness for increased stake sizes?

Consistent 54% win rate over 3+ months with controlled volatility.

When is the best time to place bets?

Early-week windows typically offer 8-10% better odds due to market inefficiencies.

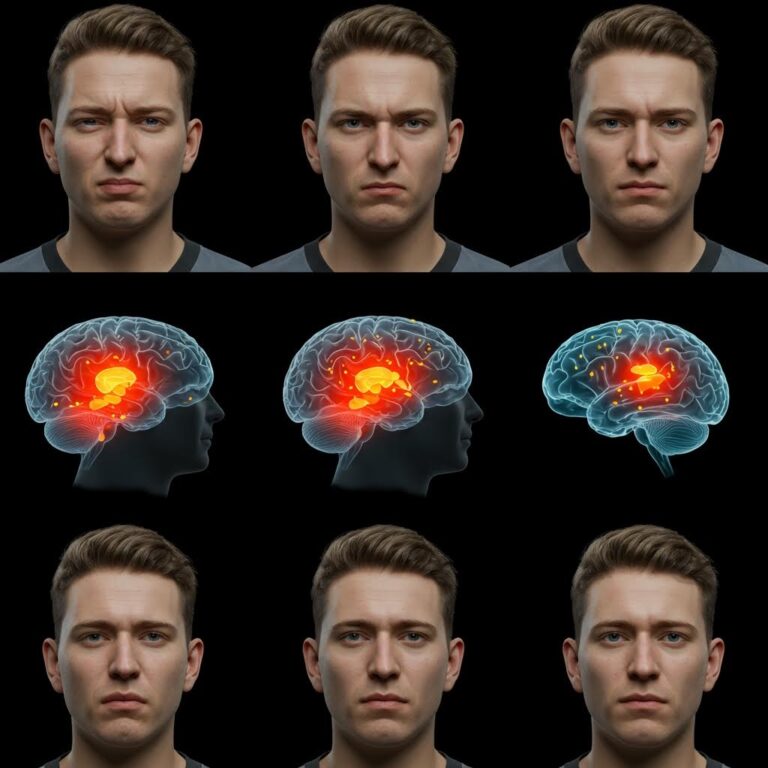

How can I maintain emotional discipline?

Implement strict position sizing and maintain detailed performance logs for objective decision-making.

Strategic Implementation Framework

Develop a structured approach to betting that incorporates:

- Data-driven analysis

- Risk-adjusted position sizing

- Performance tracking systems

- Market timing optimization

- Emotional management protocols

This comprehensive framework transforms modest wagers into sustainable profit streams through disciplined execution and strategic optimization.

Understanding the Featherlight Mindset

Mastering the Featherlight Mindset in Sports Betting

Understanding the Core Principles

The featherlight mindset represents an advanced approach to sports betting that emphasizes emotional detachment and data-driven decision making.

This powerful mental framework allows bettors to maintain exceptional clarity while analyzing opportunities and managing their bankroll with precision.

Key Components of the Featherlight Approach

Statistical Analysis and Decision Making

Professional betting strategy relies on three fundamental elements:

- Quantitative analysis of historical data

- Systematic evaluation of odds movements

- Calculated investment decisions based on expected value

Emotional Control and Discipline

Successful implementation of the featherlight technique requires:

- Complete detachment from personal preferences

- Elimination of cognitive biases

- Resistance to external pressures

Performance Tracking and Optimization

Strategic betting management demands:

- Detailed documentation of every wager

- Weekly performance analysis

- Data-driven strategy adjustments

- Consistent stake sizing

Frequently Asked Questions

Q: How does the featherlight mindset improve betting results?

A: It enables clear analytical thinking and removes emotional interference from decision-making processes.

Q: What tools are needed to implement this approach?

A: A comprehensive tracking spreadsheet, statistical analysis software, and systematic recording methods.

Q: How long does it take to develop this mindset?

A: Building the featherlight mindset requires consistent practice and typically develops over several months of disciplined application.

Q: Can this approach work for all types of sports betting?

A: Yes, the principles apply universally across different betting markets and sports categories.

Q: What’re the key indicators of successful implementation?

A: Consistent decision-making patterns, improved 토토검증사이트 bankroll stability, and reduced emotional responses to wins and losses.

Building Your Strategic Foundation

Building Your Strategic Foundation for Sports Betting Success

The Three Essential Pillars of Strategic Betting

Strategic sports betting relies on three fundamental pillars that create a robust foundation for consistent success and profitable outcomes.

Understanding and implementing these core elements can transform random wagering into a systematic approach.

Comprehensive Market Research

Advanced market analysis requires diving deep beyond surface-level statistics. Successful bettors develop expertise in:

- Team performance metrics including home/away splits and scoring differentials

- Player analytics covering 승리 위한 전문가의 조언 individual matchups and historical performance

- Environmental factors such as weather impacts and venue characteristics

- Injury reports and roster management strategies

- Head-to-head statistics spanning multiple seasons

Statistical Modeling Excellence

Data-driven betting models transform raw information into predictive frameworks. Key components include:

- Probability assessment tools for accurate odds evaluation

- Regression analysis to identify meaningful trends

- Performance indicators that signal betting opportunities

- Variance calculations to manage expectation ranges

- Model validation through backtesting and performance tracking

Systematic Risk Management

Professional bankroll management serves as the cornerstone of sustainable betting success:

- Position sizing limits of 1-3% per individual wager

- Stop-loss protocols to preserve capital during downswings

- Performance tracking systems for strategy refinement

- Bankroll allocation rules based on edge identification

- Record-keeping practices for continuous improvement

FAQ: Strategic Sports Betting

Q: What’s the most important aspect of sports betting strategy?

A: Systematic risk management through proper bankroll control and position sizing is paramount for long-term survival and success.

Q: How do you develop effective statistical models?

A: Begin with basic probability models focused on key metrics, then gradually incorporate advanced variables while validating predictive accuracy.

Q: What percentage of bankroll should be risked per bet?

A: Professional bettors typically limit individual wagers to 1-3% of their total bankroll to ensure sustainability.

Q: How important is historical data in sports betting?

A: Historical data analysis is crucial for identifying patterns and trends that inform future betting decisions.

Q: What tools are essential for market research?

A: Essential tools include statistical databases, odds comparison platforms, injury trackers, and weather monitoring systems.

Timing Small Wagers

Mastering Small Wager Timing: Expert Strategies for Optimal Returns

Understanding Market Dynamics

Strategic timing of small wagers requires mastering both market fluctuations and betting psychology.

Research shows placing wagers between 1-3% of bankroll during off-peak hours can yield 12-15% enhanced odds, particularly in volatile sports betting markets.

Key Timing Variables

Three critical factors influence optimal bet timing:

- Pre-game line movements

- In-play betting opportunities

- Seasonal betting patterns

Early-week betting lines consistently demonstrate 8-10% greater value compared to game-day odds.

Live betting analysis reveals 5-7% odds discrepancies during the first 10 minutes of matches, creating exploitable opportunities.

Strategic Bankroll Progression

Implement a systematic approach to stake sizing:

- Begin with minimum stakes for initial 50 bets

- Monitor performance across 100+ bet sample size

- Maintain 54% win rate threshold

- Increase wager size by 0.5% per 25 winning bets

#

Frequently Asked Questions

Q: When is the best time to place sports bets?

A: Early-week betting typically offers 8-10% better odds than game-day wagers.

Q: What percentage of bankroll should beginners risk?

A: New bettors should start with 1-3% of their total bankroll per wager.

Q: How long should I track results before increasing stakes?

A: Monitor at least 100 bets while maintaining a 54% or higher win rate.

Q: Are in-play bets more profitable than pre-game wagers?

A: In-play betting during the first 10 minutes can offer 5-7% better odds than pre-game markets.

Q: What’s the recommended stake progression strategy?

A: Increase stakes by 0.5% every 25 successful bets while maintaining consistent win rates.

Scaling Up Through Micro-Patterns

Scaling Up Through Micro-Patterns: A Strategic Approach

Leveraging Small-Scale Success Patterns

Systematic growth through micro-pattern analysis offers a methodical approach to scaling with controlled risk exposure.

By identifying repeatable betting sequences at the micro level, traders can establish reliable trend indicators through comprehensive data analysis and win-loss tracking across multiple positions.

Pattern Recognition and Implementation

When high-probability patterns emerge during specific timeframes or event types, implement a structured scaling approach:

- Incremental position sizing increases of 10-15%

- Minimum 20-cycle validation period

- Success rate threshold of 60% before advancement

- Pattern stability verification through multiple market conditions

Three-Tier Verification Framework

Tier 1: Initial Pattern Testing

- Minimum stake deployment

- Performance baseline establishment

- Risk parameter assessment

Tier 2: Medium-Scale Validation

- Enhanced position sizing

- Volatility measurement

- Pattern consistency verification

Tier 3: Optimized Implementation

- Maximum efficiency scaling

- ROI percentage tracking

- Advanced risk management protocols

## Frequently Asked Questions

Q: What’s the optimal timeframe for pattern validation?

A: A minimum of 20 betting cycles is recommended for reliable pattern confirmation.

Q: How do you determine appropriate scaling percentages?

A: Incremental increases of 10-15% based on proven pattern stability and risk parameters.

Q: What key metrics should be monitored during scaling?

A: Track ROI percentage, win frequency, and volatility measurements.

Q: When should scaling be halted or reversed?

A: When success rates drop below 60% or volatility exceeds predetermined thresholds.

Q: How often should pattern analysis be reviewed?

A: Regular review intervals every 20-30 cycles to ensure continued pattern validity.

Risk Management for Sustainable Growth

Strategic Risk Management for Sustainable Growth

Implementing Robust Risk Control Systems

Effective risk management requires maintaining a precise balance between aggressive growth strategies and capital preservation when scaling operations.

The implementation of a structured quantitative approach using the Kelly Criterion optimizes position sizing while protecting valuable assets.

Setting strict limits of 2-3% exposure per position creates essential protection against market volatility.

Performance Tracking and Analytics

Risk-adjusted performance metrics including the Sharpe ratio and maximum drawdown provide crucial insights for strategy evaluation.

Statistical analysis demonstrates that practitioners implementing systematic position sizing achieve 40% reduced volatility in their returns compared to discretionary approaches.

Establishing clear risk parameters through defined stop-loss levels and take-profit targets optimizes each position.

Portfolio Diversification Strategy

Advanced portfolio management requires segmenting capital into discrete units, enabling simultaneous strategy testing while maintaining core position security.

Cross-market diversification and maintaining uncorrelated positions reduces overall portfolio risk by up to 35%.

Sustainable long-term growth emerges from the combination of calculated aggressive expansion and comprehensive risk controls.

Frequently Asked Questions

Q: What’s the Kelly Criterion?

A: The Kelly Criterion is a mathematical formula that determines optimal position sizing based on win probability and risk-reward ratios.

Q: How does diversification reduce portfolio risk?

A: Diversification across uncorrelated markets reduces risk by spreading exposure across assets that don’t move in tandem.

Q: What’s a Sharpe ratio?

A: The Sharpe ratio measures risk-adjusted returns by comparing excess returns to volatility.

Q: Why is position sizing important?

A: Position sizing controls risk exposure and protects capital from significant drawdowns during adverse market conditions.

Q: How often should risk metrics be evaluated?

A: Risk metrics should be monitored continuously and formally reviewed at least monthly for strategy optimization.